Calendar Spread Mean Reversion

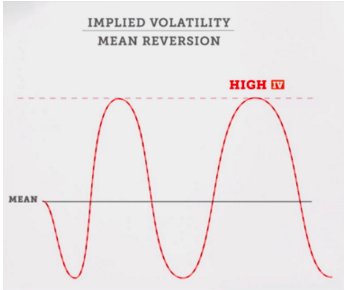

Extreme deviation from the average creates a trading opportunity in the short term.

Calendar spread mean reversion. This is most common when you trade a universe of stocks where you might get lots of trading signals on the same day. Mean reversion is a theory used in finance that suggests that asset prices and historical returns eventually will revert to the long run mean or average level of the entire dataset. So maybe this is not the best test to assess mean reversion of the spread but it is at least good to know if there is a structural break in the spread.

Please read characteristics and risks of standardized options before deciding to invest in options. If the null is rejected the series might be a unit root. For instance an up trending stock with a recent sell off has been often known to move back to the mean.

It is also known as a horizontal spread or time spread the idea behind it is to sell time and capitalize on rising in implied volatility calendar spread strategy can be traded as either a bullish or bearish strategy. Mean reversion spread trading. Calendar spread is a part of the family of spreads.

Mean reversion is assuming that there is an underlying trend in the long term and fluctuations in prices may occur. A calendar spread is a low risk directionally neutral options strategy that profits from the passage of time and or an increase in implied volatility. Ranking for a mean reversion trading strategy might be linked to your buy rules.

Off air watch rerun options involve risk and are not suitable for all investors. Kpss test differs from the three previous tests. Considering twenty two years of data through the use of mean reverting calendar spread portfolios dynamic hedge ratios and trading signals based on bollinger bands it has been shown that most combinations of front month and second month futures are significantly profitable for all commodities with the best results for wti crude and natural gas.

Futures measures tue jul 24 2018. Here only the legs vary due to different expiry dates. If a shock occurs where a b decouple the spread will trend and a mean reversion strategy will lead to losses.